Image source: The Motley Fool.

Grand Canyon Education (NASDAQ:LOPE) Q4 2018 Earnings Conference CallFeb. 20, 2019 4:30 p.m. ET

Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks:Operator

Good day, ladies and gentlemen, and thank you for standing by. Welcome to the Grand Canyon Education Incorporated fourth-quarter 2018 earnings conference call. [Operator instructions] As a reminder, this conference call is being recorded. I would now like to turn the conference over to Mr.

Dan Bachus, chief financial officer. Please begin, sir.

Dan Bachus -- Chief Financial Officer

Thank you. Joining me on today's call is our Chairman and CEO Brian Mueller. Please note that many of our comments today will contain forward-looking statements that involve risks and uncertainties. Various factors could cause our actual results to be materially different from any future results expressed or implied by such statement.

These factors are discussed in our SEC filings, including our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. We undertake no obligation to provide updates with regard to the forward-looking statements made during this call, and we recommend that all investors review these reports thoroughly before taking a financial position in GCE. And with that, I will turn the call over to Brian.

Brian Mueller -- Chairman and Chief Executive Officer

Good afternoon, and thank you and welcome to Grand Canyon Education's fourth-quarter fiscal-year 2018 conference call. During the fourth quarter of 2018, enrollment increased 7.8% to 97,400. New working adult students attending GCU online, grew in the low teens year over year, which exceeded expectations. I want to start by reviewing the size and scope of GCE services that they were delivered in the fourth quarter of 2018.

First, from the curriculum-development area, two new programs were released to the universities for implementation. I want to remind you that GCU is responsible to select all new programs, is responsible for the content and learning outcomes of those programs, sets the admissions requirements for students and the academic requirements for faculty teaching the program. The new programs were Bachelor of Science in Elementary Education, with an emphasis in STEM and a Master of Education in School Counseling. In addition, there were 11 programs and certificates that were revised or updated.

Second, from the faculty services area, there were six full-time and 245 adjunct faculty recruited and trained. There were also 100 additional sessions of faculty training and professional development. These examples of these trainings include boosting student success, the first-year experience, from theory to practice and creating collaborate classrooms. Third, in the admissions area, a total of 19,875 transcripts were evaluated, which provides prospective students the information they need in order to make a decision to start a program.

Fourth, in financial aid, 154,339 files were touched. Fifth, in the scheduling area, 19,631 classes were scheduled, with an average class size of 14.3. Sixth, our academic counselors performed 550,000 activities on behalf of students in the quarter, including activities such as welcome call to new students, course reminder calls, GPA concerns, attendance, finance changes, missing documents, practicum or licensure follow-up and schedules built or changed. Seventh, in technical support, 57.3% of the calls were answered with no hold time and if placed on hold, the average time was less than a minute and 26 seconds.

Eighth, our advertising work was very efficient in providing the necessary coverage to significantly exceed our enrollment goals. Ninth, we continued to enhance our technology platforms during the fourth quarter. We are currently working on over 80 software projects. We have successful pilot of our cloud-resource platform doing GCU's full term.

GCU has increased the use of platform, excuse me, during spring term when we are jointly modifying GCU curriculum to use the platform in additional IT, cybersecurity and programming courses going forward in both traditional and online course delivery. We continue to use our deep-analytic platform to improve student support. One key area we use this information is in automating the scheduling and tracking the field experience required in several of our programs, including education and counseling. GCE has invested over $200 million in advanced technologies, resulting in automated services and artificial intelligence to support students, faculty and counselors over the last 10 years.

I've reviewed just some of these. The objective going forward is to implement those capabilities over six core growth strategies. The goal is to work with partners to provide high-quality academic services, that will produce quality outcome metrics for the university and career opportunities for the students. The metrics include but are not limited to high graduation rates, low debt amounts and low default rates on student loans.

First, GCU's traditional ground campus will continue to grow, both in quantity and quality of the students. GCU's new nonprofit status has provided a tailwind from a new student growth perspective. In the fall of 2018, the ground campus produced a record 7,000 new students. Given the current flow of applications, registrations and deposits, for fall of 2019, we expect approximately 8,000 new students.

The average incoming GPAs will again be over 3.5 and the Honors College will grow to 2,400, with average incoming GPAs exceeding 4.1. The campus will grow to 30,000 students, with over 300 academic programs over the next five to seven years. Average revenue per student will continue to rise because the percent of all students living on campus will continue to go up. Second, the goal is to grow GCU's online campus at 6% to 7%.

However, the nonprofit status of the university has created a tailwind impact for online students as well. In the fourth quarter of 2018, new enrollments grew in the low teens, which is well above the goal. GCE will continue to support GCU's goal of growing the online campus with 60% of the students working on graduate degrees or RN to BSN degrees. This will enable the university to continue to produce quality metrics around graduation rates, loan amounts and default rates on student loans.

Third, GCE will support Orbis, as it grows its existing 18 locations, with its partners BSN licensure programs -- pre-licensure programs. Orbis will expand a number of locations through its partners by adding seven new locations in the 2019 calendar year. Orbis will continue to focus on the high-quality outcomes it has produced with its partners, including a 90% graduation rate and a 93% first-time pass rate on the NCLEX exams. Fourth, Orbis will use GCU's pre-licensure program to add a limited number of locations in certain western marketplaces, where it makes sense.

There are still over 70 markets in U.S., where Orbis can expand. Fifth, Orbis will work with its partners to expand the number of programs it offers in the healthcare area on its existing locations. Programs such as nurse practitioner, occupational therapist and physical therapy will eventually be added. There's going to be huge shortages of healthcare professionals in the next 10 years as the baby boom generation ages and requires increased levels of care.

Orbis has established an outstanding reputation for working with its University partners to produce high-quality outcomes. Sixth, GCE will continue to work with -- work to gain additional University partners. The goal is to find partners that want to combine the strength of their local or regional brand with GCE's capability to execute at a high level from an operational perspective. We continue to look for partners that are clearly differentiated based on geography, brand, programs, price point, etc.

We have walked away from several opportunities to date, because we haven't found the right amount of differentiation. In last quarter's call, I indicated we were considering five options. We've walked away from two of those, are continuing to have discussions with three and have entered into discussions with two additional entities. Now turning to the results of operations.

As a reminder, beginning July 1, 2018, the results of our operations do not include the university operations of GCU. It rather reflects the operations of GCE as a service-technology provider. Therefore, for comparability purposes, we will discuss amounts on an adjusted basis as is discussed in a minute. Service revenues were $177.5 million in the fourth quarter of 2018, compared to $271.4 million of university related revenue in the prior year.

Had the transaction occurred on July 1, 2017, comparable service fee revenue would have been $162.9 million in the fourth quarter of 2017. This represents an increase of 9% between fourth quarter of 2017 and fourth quarter of 2018 on a comparable basis. The increase year over year in comparable as adjusted revenue was due to an increase in GCU's enrollment and an increase in GCU's ancillary revenue, resulting from increased traditional student enrollment. Enrollment at GCU increased 7.8% between December 31, 2017, and December 31, 2018.

As adjusted operating income and as adjusted operating margin for the three months ended December 31, 2018, were $80.5 million and 45.3% respectively. As adjusted operating income, as adjusted operating margin for the three months ended December 31, 2017, were $69.7 million and 42.8% respectively. Technology and academic services grew from $10.7 million in the fourth quarter of 2017 to $11.1 million in the fourth quarter of 2018, an increase of $0.4 million or 3.3%. This increase was primarily due to increases in employee compensation and related expense compensation due to the increased number of staff needed to support our client, GCU and its increased enrollment, tenure-based salary adjustments and increased benefit cost between years.

As a percent of comparable revenue, these costs decreased 30 basis points to 6.3%, primarily due to our ability to leverage our technology in academic services personnel across an increasing revenue base, partially offset by the planned reinvestment of a portion of the savings provided by our lower tax rate in increased employee compensation and benefit cost. Counseling services and supports expenses grew from $50.2 million in the fourth quarter of 2017 to $52 million in the fourth quarter of 2018, an increase of $1.8 million or 3.5%. This increase is due to increased employee compensation and benefit cost between years, to service GCU and its enrollment. As a percentage of comparable revenue, these costs decreased 150 basis points to 29.3% from 30.8%, due primarily to our ability to leverage our counseling services and support expenses across an increasing revenue base, partially offset by the planned reinvestment of a portion of the savings provided by our lower tax rate in increased employee compensation and benefit costs.

Marketing and communication expenses as a percent of comparable revenue decreased 80 basis points from quarter 4, 2017 to quarter 4, 2018. General and administrative expenses increased $0.7 million between years and as a percentage of comparable revenue increased 10 basis points to 3.8% in quarter 4, 2018 from 3.7% in quarter 4 of 2017. This increase was primarily due to increases in employee compensation and benefit costs between years as our staffing increased to service GCU and its enrollment growth. With that, I would like to turn it over to Dan Bachus, our CFO, to give a little more color on our 2018 fourth quarter, talk about changes in the income statement, balance sheet and other items as well as to provide 2019 guidance.

Dan Bachus -- Chief Financial Officer

Thanks, Brian. Service revenues slightly exceeded our expectations in the fourth quarter of 2018, primarily due to GCU's higher enrollment and higher ancillary revenues. Revenue per student decreased as expected in the fourth quarter of 2018 compared to the prior year due to a shift in the timing of start dates for our clients' ground traditional students, resulting in one less revenue-producing day in the fourth quarter of 2018. GCU has not raised its tuition for its traditional ground programs in 10 years and tuition increases for working adult programs have averaged 1% or less.

Our effective tax rate for the fourth quarter of 2018 was 19.5%, compared to 25.5% in the fourth quarter of 2017. The lower effective tax rate year over year is a result of the Tax Cuts and Jobs Act, which was signed into law on December 22, 2017. The Act reduced the corporate federal tax rate from a maximum of 35% to a flat 21% rate effective January 1, 2018. The act also created the opportunity for GCE to submit method changes in conjunction with the filing of its 2017 federal tax return that resulted in a favorable impacted tax expense of approximately $1 million in the fourth quarter of 2018.

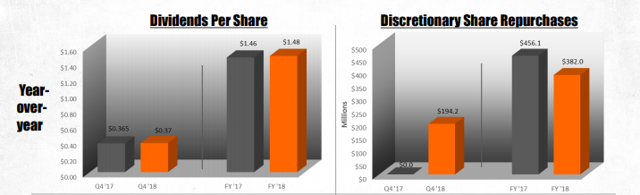

Our increased contributions made in lieu of state income taxes from $2 million in Q3 2017 to $3.7 million in Q3 2018, also helped reduce our effective tax rate. We receive a dollar-for-dollar state tax credit for these contributions, which are recorded in general and administrative expenses in the third quarter, 75% of these amounts are recorded as a reduction in the effective tax rate in the third quarter and 25% is recorded in the fourth quarter, as did the favorable impact from excess tax benefits of $2.6 million in quarter 4, 2018, compared to $1.1 million in quarter 4 of 2017. Given that the effective tax rate included in our fourth-quarter guidance was 21.7%, $0.05 of the earnings beat is due to the lower effective tax rate. We repurchased 52,784 shares of common stock in the fourth quarter of 2018 at a cost of approximately $5.5 million.

We had $88.1 million available under our share-repurchase authorization as of December 31, 2018. In January 2019, under previously executed 10b5-1 plan, we purchased an additional 107,527 shares of our common stock at a cost of approximately $10 million. Turning to the balance sheet and cash flows. Total unrestricted cash and short-term investments at December 31, 2018 were $120.3 million.

Restricted cash and cash equivalents were $61.7 million as of December 31, 2018 and represents the cash collateral on the credit agreement, which was released in January with the amended and restated credit agreement, which I will describe in a minute. GCE CAPEX in the fourth quarter of 2018 was approximately $4.4 million or 2.5% of net revenue. We estimate GCE's 2019 CAPEX, including Orbis should range between $20 million and $25 million, consisting primarily of software development and the build-out of Orbis partner locations. We anticipate funding CAPEX on behalf of GCU through the secured note of approximately $100 million in 2019.

This funding is to finish the 2018-'19 school year projects and three additional apartment-style residence halls and a parking garage for the 2019-'20 school year. Based on recent conversations with GCU, it's likely that the university will not request us to continue to fund its CAPEX after this year as the university anticipates they will be able to fund its own CAPEX moving forward. On January 22, 2019, in conjunction with the closing of the Orbis acquisition, GCE entered into an amended and restated credit agreement and two related amendments that, together, provide a credit facility of $325 million, comprised of a term-loan facility of $243.75 million and revolving credit facility of $81.25 million, both with a 5-year maturity date. The term facility is subject to quarterly amortization of principal commencing with the first quarter -- with the fiscal quarter ended June 30, 2019, in equal installments of 5% of the principal amount of the term facility per quarter.

Both the term loan and revolver have monthly interest payments currently at 30-day LIBOR, plus an applicable margin of 2%. The proceeds of the term loan, together with $6.25 million drawn under the revolver and cash on hand, were used to pay the purchase price of the acquisition. Concurrent with the acquisition and credit agreement, we repaid our $60 million in term debt and the cash collateral of $61.7 million was released. Last, I would like to provide color on guidance we have provided for 2019.

As you have probably noticed, we're again providing estimates for each quarter of 2019. We do this because our financial results including GCU and the universities that Orbis services are seasonal. The guidance that we have provided includes Orbis financial result with the exception of intangible-asset amortization, transaction costs associated with the acquisition and the tax impact for those items. We plan to provide a non-GAAP as adjusted net income beginning with the first quarter of 2019 that reconciles as reported GAAP net income to as adjusted non-GAAP net income to reflect these adjustments.

Although, the intangible asset valuation is not yet finalized, we estimate that annual book intangible asset amortization expense will be approximately $11 million and we anticipate transaction costs recorded in the first quarter of 2019 to be approximately $5 million. Our enrollment guidance assumes high single-digit GCU online new start growth. Our guidance assumes an increase in GCU graduates between years of approximately 13%. The significant retention gains and accelerated start growth GCU has experienced in recent years continues to result in year-over-year increases in graduates that exceed its total enrollment growth rate.

As we have discussed previously, enrollment growth rates for GCU ground students are impacted by a high percentage of its students are graduating in less than four years. We anticipate that GCU revenue per student will continue to grow year over year as a result of the growth of GCU's ground traditional student. GCU revenue per student will be impacted by changes between 2018 and 2019, when the traditional campus semesters begin and end and when online breaks occur. The spring, summer and fall semesters start one day earlier in 2019 than in 2018, pushing revenue from Q2 to Q1 from Q3 to Q2 and from Q4 to Q3.

The 2018 Christmas break had a net impact of pushing one day of revenue from 2018 to 2019 and the 2019 Christmas break has a net impact of pushing one day of revenue from 2019 to 2020. We estimate the effect of these changes are $900,000 of more revenue in quarter 1, $600,000 of less revenue in quarter 2, $700,000 of more revenue in quarter 3 and $1.1 million of less revenue in quarter 4. The net loss of revenue about $100,000 is related to the timing of the online Christmas breaks. We estimate the Orbis revenue will be approximately $87.7 million 2019, which represents a 40.3% growth over its 2018 revenue of $62.5 million.

Given that the close of the transaction occurred on January 22, 2019, $3.7 million of this revenue will not be recognized in our financials. Total enrollment will be approximately 101,900 at March 31, 91,000 at June 30, 109,400 at September 30 and 108,000 at December 31, with Orbis enrollment being approximately 3,200 at March 31, 3,300 at June 30, 3,800 at June -- at September 30 and 3,800 at December 31 of those amounts. On the expense side, we anticipate the core GCE business to see increased margins of 30 basis points year over year, excluding $2 million of fees incurred in Q1 2019, related to a discreet tax item that will have the effect of lowering our quarter 1, 2019 effective tax rate. This item is included in the guidance provided.

Orbis will be approximately breakeven from an EBIT standpoint, excluding the intangible asset amortization and transaction cost. We anticipate technology and academic services, counseling services and support, marketing and communications and general administrative expense will be approximately 11%, 29.8%, 18.5% and 6.1% of net revenues respectively, and thus consolidated operating margin will be 34.6% of net revenues. We estimate interest income on the note from GCU will be approximately $58.2 million as the note continues to grow over the course of 2019, as GCE funds GCU's CAPEX. We estimate interest expense will be approximately $10.5 million, declining slightly over the course of the year due to principal pay downs and that other interest income will be approximately $2.3 million, a substantial portion of which will be in Q1, 2019.

Our guidance this year assumes an effective tax rate, excluding contributions made in lieu of state income taxes to be 17.3% in Q1, 24.5% in Q2, 24.6% in Q3 and 24.1% in Q4. The lower rate in Q1 is due to the majority of restricted stock vesting occurring in that quarter each year and the decrease from the prior year is due to the discreet tax item I mentioned earlier. The year-over-year increase in the effective tax rate especially in the fourth quarter is due to higher estimated state income tax as a result of the transaction, the one-time method change benefit received in the fourth quarter of 2018 and due to the contributions in lieu of state income taxes not being factored into our guidance. If a contribution in lieu of state income taxes is made in the third quarter of 2019, it will have the effect of the increasing general and administrative expenses and decreasing income-tax expense.

Although, we might repurchase additional shares during 2019, these estimates do not assume repurchases other than those made in the first quarter. I will now turn the call back over to Brian to share a few final thoughts.

Brian Mueller -- Chairman and Chief Executive Officer

In this conference call, we have referred to three organizations: Grand Canyon Education, Orbis and Grand Canyon University. Prior to the recent transaction, Grand Canyon University and what is now Grand Canyon Education was a single entity. We operated as a single entity for 10 years and during that time, developed a culture or ethos that came to define us. Our goal was to make private Christian higher education affordable for all socioeconomic classes of Americans.

Using the public market to get access to capital and building a hybrid campus consisting of traditional students on our campus and nontraditional students online, leveraging a common infrastructure created huge efficiencies. The greater or common good was clearly being served. We were able to grow to 97,000 students, invest over $1.2 billion in educational infrastructure and not raise tuition in 10 years on a traditional campus with less than 1% increases in the online campus. This has led to huge diversity on the campus, with 28% of our students being Hispanic, 7% African-American and over 40% students of color.

Again, the greater or common good being served. Grand Canyon University is now a nonprofit institution, with its own board and mission. Grand Canyon Education is now an educational services company, with its own board and mission. There is no overlap from a broad perspective.

However, the culture or ethos of the greater or common good lives on in both organizations. This can best be witnessed in a continued commitment from both organizations to transform into inner-city neighborhood, where we both reside. Our now joint five-point plan continues to make amazing progress. We have created 10,700 jobs between the two organizations and another 400 jobs through eight new businesses.

Our partnerships in investment with the City of Phoenix police has crime dropping in the neighborhood. Our Habitat program has improved over 220 homes and housing values are up over 50% since we started the program. We now have over 1,200 students providing tutoring to over 100 local schools between 3:00 and 8:00 p.m. Monday through Friday, and 10:00 a.m.

to 6:00 p.m. on Saturday. In addition, there are dozens of student-led projects going on in the neighborhood on a daily basis to support disadvantaged populations and drive increased levels of prosperity. We like the business model at Orbis but also like their culture or ethos.

They are serving a greater or common good, as they create a win-win relationship with healthcare providers and universities in order to service students and communities in a very unique way. Orbis will continue to move forward with the full support and resource of Grand Canyon Education. Grand Canyon Education will continue to look for partners to create win-win situations that are sound and productive from a business perspective for both parties, but also always serve the greater or common good. I will now turn the call over to the moderator so we can answer questions.

Questions and Answers:Operator

[Operator instructions] Our first question or comment comes from the line of Peter Appert from Piper Jaffray. Your line is open.

Peter Appert -- Piper Jaffray -- Analyst

Thanks. Good afternoon. So Brian, based on your comments, based on the guidance, definitely feels like you're seeing a tailwind in terms of the enrollment growth numbers from the conversion. Do you have a new target in terms of what you think would be a reasonable growth rate going forward for the online business in particular?

Brian Mueller -- Chairman and Chief Executive Officer

Well, we knew that would be the first question. We still say 6% to 7% from an online standpoint. There definitely was a tailwind. We had a very strong fourth quarter, especially in terms of new starts.

We're off to a good start in the fourth -- in the first quarter. The question is how long will that last? And so we're going to be conservative like we always are. We'll try to under-promise and over-deliver. So yes, low teens, new students online growth was more than we expected.

And I think, it's evidence that being out there now a million times a day saying we're nonprofit has had an impact. We've had our competitors tell us openly. We bullied you guys every single day for 10 years with the fact that you shouldn't go to a for-profit institution. We grew in spite of that and now we are benefiting from that nonprofit status even though tuition levels haven't changed, etc.

But increasing our goals in the short run, we're not ready to do that yet.

Peter Appert -- Piper Jaffray -- Analyst

OK, fair enough. And then on the Orbis business, the growth -- enrollment growth numbers, Dan, that you gave, would that assume any new university clients? And then, sort of related to this, you've mentioned breakeven from an EBIT perspective. Any thoughts in terms of the longer-term financial model for Orbis?

Dan Bachus -- Chief Financial Officer

Yes, so that does include, as Brian said on the call, seven additional locations opening in 2019. Those partners have already been signed-up locations, have already all been determined and they will open at different times over the course of the year. They obviously, continue to work on additional partners and additional locations for 2020 and going forward but a lot of those locations and partners have already been determined for 2020 and going forward.

Brian Mueller -- Chairman and Chief Executive Officer

So the new locations in 2019 do not need additional university partners. They're going to be done with the current partners.

Peter Appert -- Piper Jaffray -- Analyst

Right. Exactly. OK. And then...

Dan Bachus -- Chief Financial Officer

In terms of margins, as we've talked about before, the EBIT is basically breakeven, which is actually slightly better than what we had thought going into the year but as they've completed their budget process that's where they got to. The margin profile of the business as a whole is highly dependent on the number of new locations that are opened during the year in comparison to the number of existing or more mature locations. And so as the percentage of new locations, as a percentage of the total number of locations decreases over time, you will see Orbis be profitable.

Peter Appert -- Piper Jaffray -- Analyst

OK. And then, last thing, Brian, in terms of the discussions with new potential OPM clients, it sounds like you're being obviously, very thoughtful in this process, which might imply that it's still a ways off in terms of signing that first client. Is that how we should think about it?

Brian Mueller -- Chairman and Chief Executive Officer

We don't have anything to announce in the next 30 to 60 days. Although, you're right, the first -- we are being very careful. This Orbis purchase for us gave us a lot to do and it's a big -- it's just -- it fits so nicely into how we feel about the future of higher education, that getting behind them and supporting them is become a big priority now. It doesn't mean we're not looking for new partners, because we are.

We've got something that we're fairly excited about that will -- we think could be very, very successful. But yes, I would say not in next 30 to 60 days.

Peter Appert -- Piper Jaffray -- Analyst

OK, great. Thank you.

Operator

Thank you. Our next question or comment comes from the line of Jeff Meuler from Baird. Your line is open.

Jeff Meuler -- Baird -- Analyst

Yeah, thank you. Just on the guidance. Dan, you gave us a ton of detail but you ran through some of it pretty quick. Just on Orbis, I think, you're saying EBIT breakeven, excluding amortization expense, which is going to be excluded from adjusted EPS.

And then we'll have to layer on, I guess, the incremental interest expense, but then there's some tax savings. I guess, just -- can you net it all out for us? Like what is the EPS impact under the new adjusted EPS methodology for 2019 in terms of the Orbis impact?

Dan Bachus -- Chief Financial Officer

So the guidance we gave includes the interest expense -- higher interest expense associated with the purchase. So that's included in the guidance. The effective tax rate does not assume the tax deduction associated with the amortization of the intangible asset, because that actually turns out to be a temporary item not a permanent item, because we'll have book amortization of that asset. So the plan is to carve out in the adjusted EPS number, to carve out the intangible asset amortization along with the tax benefit of that intangible asset amortization as well as the transaction expenses.

But everything else associated with the Orbis is in the guidance that we've given, including the higher interest rate.

Jeff Meuler -- Baird -- Analyst

Enrolling that all together, it is dilutive and that's fully embedded in this $5.10 EPS figure. I didn't have it in my numbers, I don't think some of the others that they could incorporate it in consensus had it in, so I'm just trying to I guess make things as apples for apples as possible.

Dan Bachus -- Chief Financial Officer

Yeah, I think, what we try to do is give guidance that would be in line with that as adjusted EPS number that we'll give, similar to if you're all familiar with Strayer and the Capella acquisition, we'll do something similar to that. And so the things that are carved out will be the intangible asset amortization, along with the tax impact of that and the transaction cost. Everything else is embedded in the guidance that we gave, including the higher interest expense.

Jeff Meuler -- Baird -- Analyst

Got it. And then just to follow up to Peter's question on the school services or OPM clients for GCE as opposed to Orbis. Just if and when you eventually sign a client, is there -- the initial I would imagine there's initial expense that runs ahead of revenues. So is that the case? Is there initial dilution when you are first ramping a client? Any way to size up what you think that would be or the time lag to get that client to free cash flow or adjusted EBIT profitable? And then, are you embedding anything in the 2019 guidance for potential additional client signing?

Dan Bachus -- Chief Financial Officer

No, we haven't embedded anything in either the revenue or the expense guidance associated with the new GCE client. The reason, frankly, is it's going to be highly dependent on which client we sign and how aggressive that client wants to ramp-up. So if it's a client that wants to take a slow ramp, it'll have a smaller upfront expense impact, but the revenue obviously, will ramp slower than if it's a client that wants to ramp up at a faster rate. So until we have that client signed and know what -- how fast they want to ramp up, we just can't even size that upfront loss and then the revenue impact.

Jeff Meuler -- Baird -- Analyst

OK. And then just finally to the extent to which to improved marketing efficiency persists and it's a new normal. How do you think about reinvestment, flow-through? I guess what I'm wondering if each marketing dollar is more efficient, do you spend even more on marketing to drive even more enrollment? Or at some point, do you just start to stretch your operational capabilities if you're running at a teens rate or north of that?

Brian Mueller -- Chairman and Chief Executive Officer

Well, the answer to that is continue to build the quality of the students. And so if what's currently happening continues to happen and it happens for a while with the same quality of students, producing the high-graduation rates, the low-default rates and all of that, then we'll continue to invest at the current rate, which means we would have additional dollars to invest. And that would be perfect in terms of us being able to go into a relationship with another client. Another way to talk about this new GCE client thing, is the discussions that we're having, it becomes very apparent to people, because they tip their toe a little bit into online-delivered education.

They know they can't do to it. But they also know the power of their brand locally. And when they get accustomed to what our ability to operationalize something is as compared to theirs, they get excited about combining the two things and we do too. We've talked about the Northeast for example, where our brand has the least amount of visibility.

If you combine -- I say to people all the time, how does Grand Canyon University have any students in New Jersey for example? Well, it's very simple, a teacher calls a local university and they might get a call back in 30 days and maybe something happens with financial aid in 60 to 90 days. They get frustrated. They see our ad, they call Grand Canyon and within 72 hours, everything is done. Application is filled out, transcripts are evaluated, three different schedules are built, the financial aid is done.

They go to our website, they see Grand Canyon University, who it is and they say, OK, this just sounds good and they start. That's why we have students in the Northeast. What we're trying to convince people, obviously, if you take our ability to execute and combine it with the brand and sometimes three times the price point of one of those private universities, if you would have something that could be extremely productive and profitable for both groups. We just don't want to do that with four or five institutions in the Northeast, we'd like to do it with one, maybe two.

And so that's kind of -- those are the kind of the discussions that are evolving. And we think, based upon the direction things are going now, we're going to find one or two really good partners. And GCU's accelerated growth rate in the short term will produce revenues that allow us to get involved in some way and minimize the negative impact in the short run from a margin standpoint.

Jeff Meuler -- Baird -- Analyst

Excellent. Thanks and look forward to seeing you guys, tomorrow.

Brian Mueller -- Chairman and Chief Executive Officer

OK, thank you.

Operator

Thank you. Our next question or comment comes from the line of Jeff Silber from BMO Capital Markets. Your line is open.

Jeff Silber -- BMO Capital Markets -- Analyst

Thanks. Just to focus a little bit more on your potential partnerships with new university. You mentioned you walked away from a couple -- I'm not asking for proprietary information. But at a high level, I'm just curious what drove that decision to walk away?

Brian Mueller -- Chairman and Chief Executive Officer

Well, we -- without giving specific names, we had this state university in the West that was really interested in. And we had talks and we were getting down to the -- they really wanted to be a partner of ours and we really wanted to be their partner. But as we got down to the nitty-gritty of modeling it out, it just became apparent that at the price point of that state University system, with them having programs so similar to ours, both having brands pretty visible in the West, there wasn't going to be enough differentiation to make it worth our while. It was -- there would have been just too much cannibalization there.

And it wouldn't make sense. And so that is really what happened with the two that we walked away from. So in our minds, geographic differentiation, branding differentiation, price point, those are all things that if we can find the right place and those things all work together, it will be an optimal partner. And rather than sign three or four suboptimal partners, we'd rather sign one or two optimal partners, where all those things are working.

And we've got lots of data on the Northeast and the Southeast and what we convert leads at and what price point we can charge versus what our competition is charging. And so we're being careful. And we'll get there, we will get there. We'll get there with the right people.

But in addition to that, and I can't tell you how excited we are about this Orbis thing. They've got a really, really good business. And it's got tremendous scale potential and the class that -- the path to profitability is very clear. And so we'll continue with university of -- with Grand Canyon University.

We'll continue with Orbis and we'll eventually find the right one or two partners that can really enhance Grand Canyon Education.

Jeff Silber -- BMO Capital Markets -- Analyst

OK, that's great. And I don't mean to deflect attention away from Orbis. I know we're going to be hearing a lot about it tomorrow evening. But just to go back to the other university partners.

And again, I'm not asking for proprietary information, but at a high level are you approaching them with the revenue share agreement similar to what you have at Grand Canyon University? Is it more of a fee for service? Or are you flexible on either pricing model?

Brian Mueller -- Chairman and Chief Executive Officer

We're doing the same. We're approaching them with the same model that we have here. Although, I will tell you that we've got one program that is a little bit different than -- and one that we're -- will come out of left field and we're very excited about. We'll see if it happens.

I can't give you any more detail on that. Hopefully, in 30 to 60 days, I will be...

Dan Bachus -- Chief Financial Officer

I think, Jeff, we're flexible. I mean, our preference will be a revenue share similar to GCU but that doesn't mean we wouldn't do a cost-plus or some other type of arrangement.

Jeff Silber -- BMO Capital Markets -- Analyst

Got it. And I just got one more follow-up on the guidance. And forgive me I can read this about in the transcript, but did you say that if we take out the Orbis impact on your guidance that the pure business itself, you're looking at about 30 basis points in margin expansion in 2019? Is that what I heard?

Dan Bachus -- Chief Financial Officer

Yeah, that's correct. The guidance includes 30 basis points of margin expansion for the core GCE business.

Jeff Silber -- BMO Capital Markets -- Analyst

All right, perfect. Thanks so much.

Dan Bachus -- Chief Financial Officer

We have reached the end of our fourth-quarter conference call. We appreciate your time and interest in Grand Canyon Education. If you still have questions, please contact myself, Dan Bachus. Thank you very much for your time.

Operator

[Operator sign-off]

Duration: 44 minutes

Call Participants:Dan Bachus -- Chief Financial Officer

Brian Mueller -- Chairman and Chief Executive Officer

Peter Appert -- Piper Jaffray -- Analyst

Jeff Meuler -- Baird -- Analyst

Jeff Silber -- BMO Capital Markets -- Analyst

More LOPE analysis

This article is a transcript of this conference call produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not assume any responsibility for your use of this content, and we strongly encourage you to do your own research, including listening to the call yourself and reading the company's SEC filings. Please see our Terms and Conditions for additional details, including our Obligatory Capitalized Disclaimers of Liability.

10 stocks we like better than Grand Canyon EducationWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has quadrupled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Grand Canyon Education wasn't one of them! That's right -- they think these 10 stocks are even better buys.

See the 10 stocks

*Stock Advisor returns as of January 31, 2019

Brokerages predict that Acadia Healthcare Company Inc (NASDAQ:ACHC) will post earnings of $0.48 per share for the current fiscal quarter, Zacks Investment Research reports. Eight analysts have made estimates for Acadia Healthcare’s earnings, with the highest EPS estimate coming in at $0.51 and the lowest estimate coming in at $0.32. Acadia Healthcare posted earnings per share of $0.61 during the same quarter last year, which would indicate a negative year-over-year growth rate of 21.3%. The business is expected to issue its next earnings report after the market closes on Thursday, February 28th.

Brokerages predict that Acadia Healthcare Company Inc (NASDAQ:ACHC) will post earnings of $0.48 per share for the current fiscal quarter, Zacks Investment Research reports. Eight analysts have made estimates for Acadia Healthcare’s earnings, with the highest EPS estimate coming in at $0.51 and the lowest estimate coming in at $0.32. Acadia Healthcare posted earnings per share of $0.61 during the same quarter last year, which would indicate a negative year-over-year growth rate of 21.3%. The business is expected to issue its next earnings report after the market closes on Thursday, February 28th. Cowen reiterated their hold rating on shares of Johnson Controls International (NYSE:JCI) in a research note released on Friday. Cowen currently has a $32.00 price target on the stock.

Cowen reiterated their hold rating on shares of Johnson Controls International (NYSE:JCI) in a research note released on Friday. Cowen currently has a $32.00 price target on the stock.

Victory Capital Management Inc. cut its holdings in Aerojet Rocketdyne Holdings Inc (NYSE:AJRD) by 10.1% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The fund owned 2,064,627 shares of the aerospace company’s stock after selling 232,451 shares during the period. Victory Capital Management Inc. owned 2.64% of Aerojet Rocketdyne worth $72,737,000 at the end of the most recent reporting period.

Victory Capital Management Inc. cut its holdings in Aerojet Rocketdyne Holdings Inc (NYSE:AJRD) by 10.1% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The fund owned 2,064,627 shares of the aerospace company’s stock after selling 232,451 shares during the period. Victory Capital Management Inc. owned 2.64% of Aerojet Rocketdyne worth $72,737,000 at the end of the most recent reporting period.