With a difficult 2018 in the books and a similarly difficult short-term future ahead, Harley-Davidson (NYSE:HOG) was still able to return significant value to shareholders. With the low PE ratio of 11.6 versus the industry average of 14.6 and optimism over new products, international expansion and the stabilizing domestic market, now is a great time to buy in on Harley-Davidson's turnaround story.

OverviewWhen Harley-Davidson (NYSE:HOG) reported fourth quarter 2018 earnings results, the company missed market expectations with a revenue decline of 9% year over year and non-GAAP and GAAP EPS of only $0.17 and $0.00, respectively. This was a huge reversal from an impressive third quarter where revenue was up 16.4% year-over-year and non-GAAP and GAAP EPS of $0.78 and $0.68, respectively. In the third quarter, I was optimistic on the company's future given the improving domestic results, international expansion, and innovation which was continuing to fuel returns to shareholders in the form of dividends and buybacks. Let's take a look at what went wrong in the fourth quarter.

Domestic ResultsHarley-Davidson's domestic business is continuing to struggle, with shipments declining 10.1% in the fourth quarter. While this is consistent with the full year 2018 reduction of 10.2%, it is a slight improvement from the 13.3% decline in Q3 2018. This isn't a new trend and Harley-Davidson has been fighting the headwinds for years as the domestic market is hurting due to increased competition fighting for less new motorcycle demand. For new riders, there are plenty of less expensive options than buying a new Harley-Davidson motorcycle. They have other manufacturers in the new motorcycle space or they can buy a used Harley-Davidson as aging riders are selling, both at much lower cost points. In order to help stabilize the domestic market, Harley-Davidson is focusing on lower inventory, increasing margins, continuing to build their brand, and increasing motorcycle ridership. This can be seen in the company's strategy and 2027 objectives: build 2 million new riders in the U.S. and launch 100 new high impact motorcycles and do so profitably and sustainably.

Despite the double-digit decline in shipments, the company has made some headway in this goal by increasing the number of Harley-Davidson riders by 52,000 over the past year. This has been accomplished by four major initiatives including Harley-Davidson Riding Academy, innovation leading to new products, Freedom Promise, and influencer and entertainment integrations. These initiatives were largely successful for the year. The Harley-Davidson Riding Academy increased its sales conversion by 2.2%, the new LiveWire bike debuted at the EIMCA show in Milan, and 17,000 opportunities for a customer to trade-up to a new motorcycle. Additionally, the total estimated media value was up over 80% compared to 2017. These investments are key to stabilizing the reduction in domestic shipments and appear to be gaining momentum that should pay off in the future.

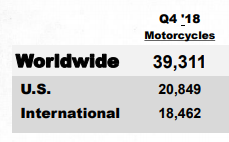

Expanding InternationallyAlso in the company's strategy and 2027 objectives is growing international to 50% of annual volume. This will be a shift from the Q4 2018 sales mix of 53% domestic vs. 47% international which shifted slightly from the Q3 2018 sales mix of 61% domestic vs. 39% international.

Note: Obtained from the company's investor relations site.

While the company will achieve this mix through domestic attrition, international retail motorcycle sales were down 2.6% in the fourth quarter of 2018 compared to the same quarter in 2017. This was a slight reversal in recent trend considering that international retail motorcycle sales were up 2.6% in the third quarter of 2018. Management attributed the decline due to ongoing weakness in Japan and Australia. These two markets experienced reduced industry sales and competitive new product introductions. Despite the weakness, Harley-Davidson was able to continue sprawling its retail network with 56 new dealers opening in 2018 with 28 in the fourth quarter alone.

In order to reach 50% of annual volume goal, the key is really just replicating the domestic business model. This focuses on expanding the dealer network, building the Harley-Davidson brand awareness, and increasing sales/profitability. This will take time, but Harley-Davidson is making all of the right moves. The company anticipates opening 25-35 new full-line dealerships per year through 2027. Additionally, the company recently opened a plant in Thailand in an effort to improve margins in the international markets.

Innovating New ProductsIn addition to returning value to shareholders through buybacks and dividends, management is committed to innovating new products to drive revenue. In addition to creating a large portfolio of new bikes, the company finally announced official plans to build the Livewire bike that was announced in 2014. After years of waiting, the Model Year 2020 motorcycle was finally released at CES this past year. There were a few key details released including:

Top speed: 110 mph Acceleration: 0 to 60 mph in under 3.5 seconds with 100% of its rated torque always available Distance: Estimated 110 miles of urban road Price: $29,799

Note: Photo obtained from Revzilla.

It has been a long road to get to this point, but it's finally gaining traction and dealers are excited to add the electronic motorcycle to their sales portfolios. With these latest announcements, preorder is available now with availability in August 2019. It's encouraging to see Harley-Davidson moving away from traditional bikes in response to market trends. I continue to expect the introduction of the electric motorcycle to be the necessary direction of the future market and a key factor for the company's long-term success. And as I've stated many times before, when it comes to introducing a motorcycle to the market, there is no one I trust more than Harley-Davidson.

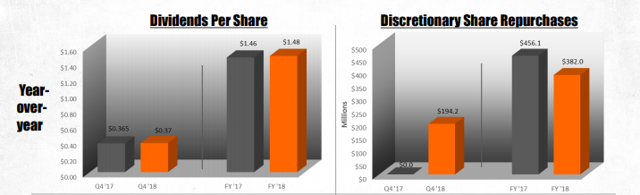

Returning Value to ShareholdersHarley-Davidson's management has a commitment to returning value to shareholders and the fourth quarter was consistent with their track record. In the fourth quarter of 2018, the company paid a quarterly dividend yield of 4.2% and repurchased $194.2 million of stock. See the comparisons to 2017 below.

Note: Obtained from the company's investor relations site.

Consistent with previous years, the dividend payout received its annual increase. The quarterly dividend increased to 37 cents per share from 36.5 cents per share which represent a near 1.4% increase. As stated by Harley-Davidson management during the earnings call:

Despite the challenges we faced in 2018, Harley-Davidson's demonstrated its incredible resilience by growing revenue and profits, delivering significantly higher year-over-year operating cash and returning $628 million to our shareholders through dividends and share repurchases.

Additionally, at the end of the fourth quarter, 16.4 million shares remained on board-approved share repurchase authorizations; therefore, I fully expect additional buybacks on any market weakness which will help create a floor for the shares.

ValuationThe stock has traded lower as a result of shipment decline during the quarter despite management forecasting a full year decline of 3% to 5% in 2019 (vs. 6.7% in 2018). This decrease over the past quarter has lowered the PE ratio to 11.6 which is cheap for the company on all fronts as the industry average is 14.6, the S&P 500 is 18.4, and the stock's 15.1 5-year average (all metrics as of 2/20/2019).

Note: 3 Month Stock Price history chart obtained from Morningstar.

ConclusionDespite slowing demand in the U.S., Harley Davidson is optimistic internationally despite growing competition resulting in a fourth quarter sales slowdown. With the company's strategy focusing on growing internationally, stabilizing domestically, and innovating products with a mission to return value to its shareholders, I am optimistic about the company's future. There is no reason that company can't replicate its domestic success internationally while retaining its dominance in the U.S. With a difficult 2018 in the books and a similarly difficult short-term future ahead, the company was still able to return significant value to shareholders. With the low PE ratio of 11.6 versus the industry average of 14.6 or nearly 26%, now is a great time to buy in on Harley-Davidson's turnaround story.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in HOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment